can you go to jail for not paying taxes in south africa

Sars has the option to send an offender to jail for a period of up to 2 years. Tax evasion cases mostly start with taxpayers who.

As with failure to file taxes you can also go to jail for failure to pay taxes.

. Misreport income credits andor deductions on tax returns. More than a century ago prison was a real risk for many types of ordinary household debt. Porter said that HMRC together with the Crown Prosecution Service CPS have increasingly been pushing for instances of tax evasion to be considered in more serious categories of offence and so carry a higher penalty.

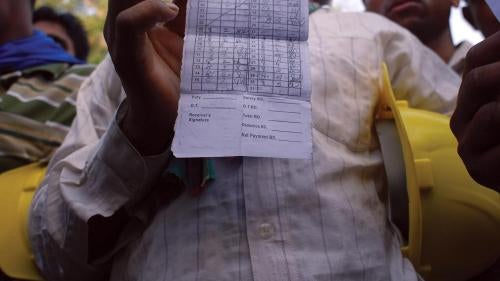

Prescribed debt for certain loan types. While you could spend up to six months in jail there are also. When paying bail you must get a receipt.

Any action you take to evade an assessment of tax can get one to five years in prison. In 2016 the IRS launched nearly 3400 investigations related. The kind of loan that you owe determines if you will go to jail for not paying it or not.

If you do not include the information in your tax filing either accidentally or in error the chances are that the IRS will find out through some other reporting mechanism. Your penalty will now be the smaller of 135 or 100 of your total tax debt. According to experts in South Africa there is a distinction made between Group A personal loans vehicle loans credit cards and store accounts and Group B home loans court-ordered debt and debt owed to the South African Revenue Services.

If you refuse to pay your taxes or child support for instance you might be sent to jail. It can take many forms including not reporting income claiming expenses for work not actually performed or owed or simply not paying taxes. Most notably your credit score can be impacted and any debts you owe generally stay on your credit report for seven years.

Attend to legal documents and letters immediately. About a hundred people a year are sent to prison for council tax arrears here is a case where a mother was in prison for 40 days before being released. But if you conceal assets and income that you should use to pay your back taxes that.

Can Sars send you to jail. What can happen if you dont pay what you owe Your credit will take a big hit. The reason is that the non-payment of your taxes or child support is a federal crime which can be classified as contempt of court.

You cant buy the things you want take out a bond or may even cause you problems getting that job you have dreamed of. 2 no person will go to prison for debt and its provisions ensure no one will be incarcerated for it. It rarely happens but its important to know the sorts of debt where this is a possibility.

For debt incurred with a credit card such as all personal debt this is a fair result. The IRS mainly targets people who understate what they owe. Notify all your creditors of change of address 2.

The IRS doesnt pursue many tax evasion cases for people who cant pay their taxes. This can affect. Another consideration is the time specifications afforded to certain loan types.

In almost all cases the answer to this is no. And if many years have passed you may have gotten lucky. When the court case is over the bail money is paid back even if the accused is found guilty.

About 30 people a year go to prison for not having a TV licence although new sentencing guidelines in 2017 should. Even if it doesnt land you in jail not paying your debts will certainly have other negative consequences on your life. And you can get one year in prison for each year you dont file a return.

According to the 1987 Charter 1 pd. The answer is yes according to tax consultant Vincent Radebe. But if you filed your tax return 60 days after the due date or the extended due date then you might have a bigger penalty.

In modern times theres no possible way you could go to prison for non-payment of most types of debt. DebtBusters offers you 4 tips to avoid getting your name listed. The first debt that you can indeed be prosecuted and put behind bars for is failure to pay taxes better known as tax evasion or in the words of the IRS tax fraud.

Deliberately not paying or underpaying federal taxes can lead to a prison sentence but only if youve been charged with and convicted of a tax-related crime such as filing a fraudulent tax return or not filing a tax return at all. But its highly unlikely unless you owe hundreds of thousands of dollars. There is 10-year a statute of limitations on collecting late taxes.

If you do file a return but arent able to pay your taxes the federal government wont throw you in prison. However if the accused does not come to court on the day of their court case or if they break any of their bail conditions the bail may be forfeited. Under the Internal Revenue Code 7201 any willful attempt to evade taxes can be punished by up to 5 years in prison and 250000 in fines.

The statute of limitations for the IRS to file charges expires three years from the due date of the return. The maximum penalty for income tax evasion in the most serious cases is a seven year prison sentence or an unlimited fine. Failure to pay child support also can put you.

If you cant pay your taxes. For most tax evasion violations the government has a time limit to file criminal charges against you. So the truth is you will pay eventually.

The IRS has the authority to impose fines and penalties. Whether the gain is from selling stocks real estate or some other capital asset the IRS wants to know about it. This penalty is usually 5 of the unpaid taxes.

Bail is a sum of money paid to the court or to the police. The penalty charge will not exceed 25 of your total taxes owed.

Life After White Collar Crime The New Yorker

Rip Nelson Mandela Celebs Pay Their Respects To The Late South African Leader On Twitter E Online

Transcript Of Trump S Speech At Rally Before Us Capitol Riot Ap News

What We Can Learn From Nelson Mandela Today Time

Is Your Landlord Harassing You Property Manager Examples How To Report

For A Better Life Migrant Worker Abuse In Bahrain And The Government Reform Agenda Hrw

Can You Get Arrested For Debt In South Africa Greater Good Sa

Can You Get Arrested For Debt In South Africa Greater Good Sa

Countries And Their Prostitution Policies Prostitution Procon Org

Full Transcript Of Exclusive Putin Interview With Nbc News Keir Simmons

Do You Go To Prison For Making A Mistake On Your Taxes Quora

Jim Crow Laws Definition Facts Timeline History

Apartheid Ended 20 Years Ago So Why Is Cape Town Still A Paradise For The Few Cities The Guardian

Youtuber Chille Decastro Pleads Not Guilty Will Represent Himself In Ironton Court

Cristiano Ronaldo Agrees To 18 8 Million Tax Evasion Fine And Jail Term News Dw 15 06 2018